The Complete Guide to Sourcing Yoga Fabric in 2025

For activewear brands entering the yoga apparel market, fabric selection determines product performance, customer satisfaction, and ultimately, market success. This guide synthesizes two decades of industry practice with current technical standards to provide a framework for informed sourcing decisions.

Understanding Elastic Fabric Fundamentals

Yoga practice demands fabrics that accommodate extreme ranges of motion—180-degree splits, deep twists, inversions—while maintaining shape integrity through repeated wear and washing. This requires three core fabric properties: multi-directional stretch exceeding 35%, elastic recovery above 95%, and compression without constriction.

The industry standard solution combines nylon or polyester base yarns with spandex (elastane), typically in knitted construction rather than woven. The knitting process inherently provides elasticity, while spandex adds controlled recovery and shape retention.

Two-Way vs Four-Way Stretch: Technical Distinctions

Two-way stretch fabrics provide elasticity in one direction only—typically horizontal (weft direction). Stretch capacity ranges from 20-30%, suitable for casual wear but inadequate for yoga's multi-planar movements. These fabrics cost $18-28 per meter.

Four-way stretch fabrics provide bi-directional elasticity: 35-50% horizontal stretch and 30-45% vertical stretch. This allows unrestricted movement in any direction. Pricing ranges from $28-50 per meter depending on composition and weight. For yoga applications, four-way stretch is non-negotiable.

Base Fiber Selection: Nylon vs Polyester

Nylon-spandex blends (typically 80-88% nylon, 12-20% spandex) offer superior hand feel, natural luster, moisture absorption, and pilling resistance. These properties make nylon ideal for premium products and garments worn directly against skin. Material costs run 15-25% higher than polyester equivalents. Nylon's primary weakness is lower UV resistance, relevant for outdoor applications.

Polyester-spandex blends (75-85% polyester, 15-25% spandex) provide excellent color fastness, easy care properties, and durability at lower cost. The fiber has a firmer hand and lower moisture absorption compared to nylon. Polyester works well for value-oriented products and training apparel where frequent washing matters more than premium feel.

Many manufacturers now offer tri-blends combining nylon, polyester, and spandex to balance performance characteristics against cost constraints.

Technical Specifications That Matter

Spandex Content: Finding the Optimal Range

Spandex percentage directly correlates with fabric elasticity and compression support:

- 8-12% spandex: Light compression suitable for gentle yoga styles, Pilates, or athleisure. Insufficient support for demanding practices.

- 12-18% spandex: Industry standard for general yoga practice. Provides balanced elasticity, recovery, and comfort across multiple body types.

- 18-25% spandex: High compression for vigorous practices (Ashtanga, power yoga) and athletic builds. Higher cost; may reveal body imperfections.

- 25%+ spandex: Extreme compression typically reserved for competitive athletics. Reduced breathability; difficult to don and doff.

For brand launches, 82% nylon with 18% spandex represents the most reliable specification—sufficient performance with broad consumer appeal.

Fabric Weight Considerations

Fabric weight measured in grams per square meter (GSM) determines thickness, opacity, breathability, and seasonal appropriateness:

180-210 GSM: Lightweight construction for summer shorts, crop tops, and quick-dry applications. Good breathability but may lack opacity when stretched.

210-240 GSM: Medium-light weight appropriate for spring/summer full-length tights and long-sleeve tops. Balances coverage with climate suitability.

240-270 GSM: All-season standard weight for yoga pants and bodysuits. Best choice for initial product development—minimizes inventory risk while providing year-round versatility. This weight range delivers optimal opacity under stretch without excessive thickness.

270-300 GSM: Medium-heavy construction for fall/winter products and outdoor training. Enhanced coverage and warmth with reduced breathability.

300+ GSM: Heavy winter fabrications, often incorporating brushed or fleece backing. Limited yoga applications; more relevant for outdoor athletics.

Brands targeting multiple climate zones should develop 240-260 GSM as core specification, with lighter weights for tropical markets and heavier options for northern territories.

Width Specifications

Standard circular knitting machines produce 150-165cm width fabrics. Wide-width variants reach 180-200cm. While wide-width fabrics carry 5-10% price premiums, cutting room efficiency improves 8-12%, resulting in net cost reduction. For high-volume production, wide-width specifications merit consideration.

Width tolerance should be negotiated at ±2cm. Tighter tolerances increase cost without meaningful benefit for most applications.

Quality Standards and Testing

Essential Physical Properties

Professional sourcing requires documented test results from accredited laboratories or factory testing facilities. Six properties prove critical:

Elastic Recovery: Measures fabric's ability to return to original dimensions after repeated stretching. Test standard GB/T 13772.2 specifies 500 extension cycles. Minimum acceptable performance: 90% recovery. Target specification: ≥95%. Fabrics below 90% will show visible bagging after limited wear.

Breathability: Quantifies moisture vapor transmission. Test standard GB/T 5453 measures grams transmitted per square meter over 24 hours. Minimum: 2500 g/㎡/24h. Target: ≥3500 g/㎡/24h. Lower values create uncomfortable heat and moisture buildup during practice.

Color Fastness to Washing: Measures dye stability through laundering. Test standard GB/T 3921 uses standard detergent and mechanical action. Grade 3 shows noticeable fading. Grade 4 demonstrates minimal change. Specify minimum Grade 4 for consumer satisfaction.

Pilling Resistance: Evaluates surface fuzzing and pill formation. Test standard GB/T 4802.1 simulates abrasion. Grade 3 acceptable; Grade 4 preferred for premium products.

Wicking: Measures moisture transport from skin to fabric surface. Test standard FZ/T 73023 quantifies capillary rise. Target ≥12mm for performance products; minimum 8mm for standard quality.

Dimensional Stability: Shrinkage testing per GB/T 8629. Maximum acceptable shrinkage: 3% in any direction. Target: ≤2%. Shrinkage exceeding 3% causes significant fit problems and customer returns.

Field Testing Methods

Laboratory analysis provides objective data, but simple field tests catch obvious problems before committing to production:

Stretch Test: Extend fabric to 1.5x original length in both directions. Release should recover to original dimension within 3 seconds. Repeat 10 times—permanent elongation indicates poor elastic recovery.

Light Transmission Test: Stretch fabric against light source. Quality fabrics show uniform yarn distribution; inferior materials reveal irregular mesh patterns and excessive sheerness.

Crease Recovery: Crush fabric in fist for 5 seconds. Release and observe wrinkle recovery speed. Premium fabrics recover within 2 seconds.

Sewing Test: Run fabric through production sewing machine. Check for skipped stitches, thread breakage, and wavy seams—all indicators of poor dimensional stability or excessive stretch during sewing.

Abrasion Test: Rub white cloth vigorously against dark fabric 20 times. Significant color transfer indicates poor dye fixation.

Common Quality Failures

Pilling: Surface fiber ends work free and ball up through friction. Caused by insufficient yarn twist, low-quality fibers, or loose knit construction. Prevent by specifying Grade 3 minimum pilling resistance.

Snagging: Fabric catches easily on fingernails or sharp objects. Results from loose knit structure or insufficient yarn strength. Particularly problematic in retail environments where customers handle merchandise.

Color Variation: Batch-to-batch color differences. Stems from inconsistent dyeing procedures or raw material variations. Address through strict color tolerance specifications (AATCC Grade 4) and requesting large-lot dyeing when possible.

Dye Migration: Color bleeds onto skin or adjacent fabrics when wet. Indicates poor dye fixation. Specify minimum Grade 4 wash fastness and Grade 4 perspiration fastness.

Loss of Compression: Garments become baggy after limited wear. Caused by low spandex content, poor-quality spandex, or inadequate elastic recovery. Prevent through recovery rate testing and spandex content verification.

Supplier Selection Framework

Required Certifications

OEKO-TEX Standard 100: Non-negotiable for European and North American markets. Tests for harmful substances including formaldehyde, heavy metals, pesticides, and banned azo dyes. Without this certification, major retailers will not accept products.

ISO 9001: Quality management system certification. Indicates documented processes for consistent production. Minimum requirement for professional manufacturing.

GRS (Global Recycled Standard): Increasingly important for brands emphasizing sustainability. Verifies recycled content and responsible production. Currently optional but trending toward market expectation.

BSCI or WRAP: Social compliance certifications required by major brands and retailers. Documents fair labor practices, safe working conditions, and environmental responsibility.

GOTS, Bluesign, and other specialized certifications add credibility but remain optional unless targeting specific market segments.

Production Capacity Assessment

Mills frequently exaggerate capacity. Verify claims through specific questions:

Equipment inventory: Request circular knitting machine count. Each machine typically produces 8-12 tons monthly. A 50-machine operation theoretically produces 400-600 tons monthly, though 70-80% utilization represents realistic capacity.

Dyeing and finishing equipment: Inquire about dyeing vessels, heat-setting machines, and finishing line capacity. Bottlenecks here limit overall output regardless of knitting capacity.

Current order backlog: Request visibility into production scheduling. Mills operating at 90%+ capacity may struggle to accommodate rush orders or volume growth.

Workforce size: Production workers, quality control team, and technical support staff indicate operational depth.

Lead Time Benchmarks

Stock fabric programs: 1-3 days for existing colors in inventory. No minimum order quantity. Best for rapid product development and fill-in orders.

Custom dyeing of standard constructions: 15-25 days for 100-500kg orders. Requires raw (greige) fabric inventory.

Standard production: 25-35 days for 500-2000kg orders of custom colors or specifications.

Large production runs: 35-50 days for orders exceeding 2000kg. Includes raw material procurement, knitting, dyeing, and finishing.

Expedited production: 15-20 days possible for 10-20% premium. Requires factory capacity availability and existing raw material inventory.

Chinese New Year (typically late January/early February) disrupts production 3-4 weeks. Plan accordingly.

Service Capabilities That Matter

Sample provision: Quality suppliers provide 3-5 color swatches free of charge for initial evaluation. Some offer larger yardage samples (1-2 meters) for prototype development.

Technical consultation: Mills with experienced technical teams can recommend appropriate constructions for specific applications. This expertise proves valuable during product development.

Low minimum orders: Standard industry MOQ runs 500-1000 meters per color. Mills supporting 100kg minimums enable smaller brands to access custom colors. Stock programs eliminate MOQ entirely.

Testing facilities: In-house laboratories expedite quality verification and reduce external testing costs. Verify laboratory capabilities match required test standards.

Transparent pricing: Beware of mills reluctant to provide detailed quotations. Professional operations offer clear pricing with volume breaks and payment terms specified.

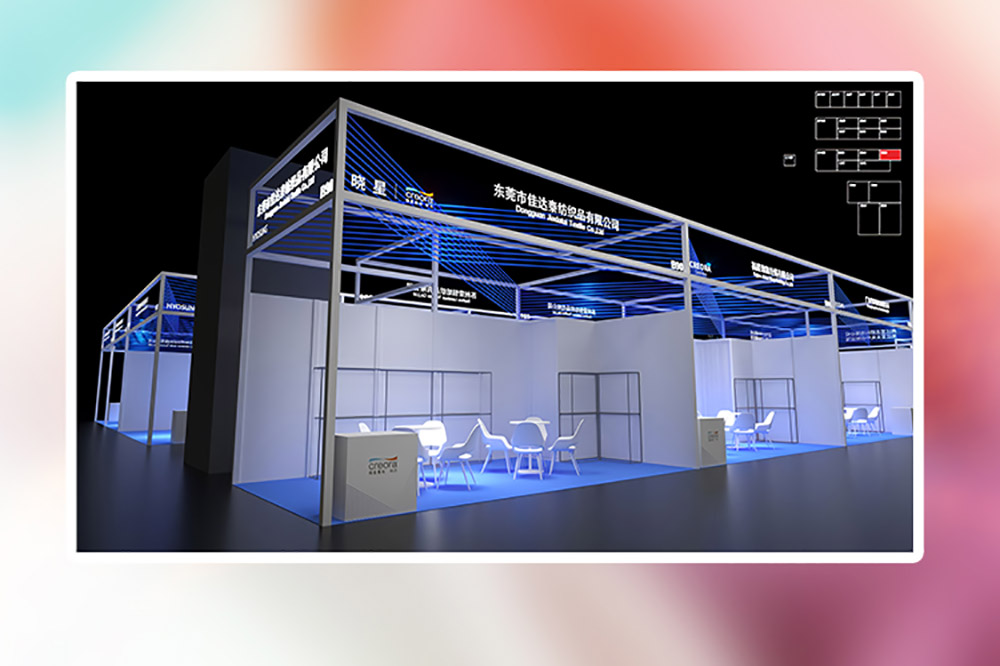

Case Example: Integrated Manufacturing

Jiadata Textile Products Co., Ltd., established 2004 in Dongguan, Guangdong Province, exemplifies vertically integrated production. The facility operates proprietary knitting, dyeing, and finishing departments, eliminating third-party markups typical of trading companies. Stock fabric programs carry no minimum order quantity; custom specifications start at 100kg. The mill maintains OEKO-TEX Standard 100, ISO 9001, GRS, and Higg Index certifications. An in-house laboratory provides complete testing capabilities. This vertical integration delivers advantages in lead time control, quality consistency, and cost structure compared to operations outsourcing dyeing or finishing.

Procurement Process Best Practices

Request for Quotation Structure

Effective RFQs produce comparable quotes and eliminate ambiguity:

Physical specifications: Four-way stretch knit, 82% nylon/18% spandex (or alternative composition), 240-260 GSM, 160cm width ±2cm tolerance.

Color requirements: Provide Pantone TPX numbers, physical swatches, or digital color standards. Specify acceptable color tolerance (recommend ΔE ≤1.0 or AATCC Grade 4).

Quality standards: Minimum elastic recovery 95%, wash fastness Grade 4, pilling resistance Grade 3, shrinkage ≤2%.

Certifications: OEKO-TEX Standard 100 required; specify if additional certifications needed.

Order quantity: Initial order (kg), anticipated monthly volume. Provide volume projections for pricing context.

Commercial terms: Request FOB pricing, lead time from PO, payment terms, sample policy.

Additional requirements: Note if requiring stock availability, small-lot capability, or technical development support.

Sample Evaluation Protocol

Stage 1 - Initial Assessment (1-3 days): Evaluate hand feel, color accuracy, and weight. Conduct basic stretch/recovery test. Trial-sew small section.

Stage 2 - Laboratory Testing (5-7 days): Submit to third-party laboratory (SGS, Intertek) or factory lab for complete physical property analysis. Focus on elastic recovery, color fastness, and shrinkage.

Stage 3 - Wear Testing (7-14 days): Construct 2-3 sample garments. Subject to actual use including multiple wash/dry cycles. Collect wearer feedback on compression, comfort, and durability.

Stage 4 - Pre-Production Approval (3-5 days): Confirm production standard sample (PP sample) with mill. This sample becomes contractual reference for bulk production acceptance.

Document all stages with photographs and written observations. Signed sample approval forms prevent disputes during bulk production.

Purchase Order Essentials

Contract terms requiring explicit documentation:

- Physical specifications reference specific approved sample by identification number

- Quality standards cite test methods and minimum acceptable results

- Delivery date stated as calendar date, not "XX days from order"

- Color tolerance defined (AATCC Grade 4 or ΔE value)

- Shrinkage allowance specified (typically ±2%)

- Payment schedule (typical: 30% deposit, 70% before shipment)

- Penalty clauses for late delivery and quality failures

- Packaging requirements (roll length, identification labeling)

- Inspection rights and acceptance criteria

Receiving Inspection Checklist

External examination: Verify packaging integrity. Confirm labels show correct specification, color, lot number.

Quantity verification: Weigh entire shipment (allow ±3% tolerance). Count rolls and verify declared meterage.

Quality sampling: Inspect 10-meter section from middle of each roll or every 5th roll for large shipments. Check for shading, defects, weight variation.

Comparison to standard: Place fabric alongside approved sample under standard lighting (D65 light box). Assess color match.

Conditional acceptance: Minor deviations may warrant 5-10% price adjustment rather than full rejection. Significant quality failures justify rejection and replacement. Late delivery penalties should follow contract terms.

Cost Management

Hidden Cost Factors

Published fabric prices represent only partial total cost:

Color shade variation: If received fabric shows off-shade issues, additional material purchases create 2-5% cost premium.

Shrinkage allowance: Purchase 2-3% extra yardage to compensate for dimensional changes during cutting and sewing.

Defect loss: Allow 1-3% for cutting around flaws and shade variations.

Logistics: Domestic shipping adds 3-5%; international freight adds 5-8% to landed cost.

Customs duty: Variable by destination country and trade agreements.

Working capital: Deposit ties up cash flow before revenue generation.

True cost per unit = (Fabric price × 1.08) + freight + duty + financing cost

Cost Reduction Strategies

Consolidated purchasing: Combine multiple colorways in single purchase order to reach volume pricing breaks and share shipping costs.

Direct mill sourcing: Eliminate trading company margins by purchasing directly from manufacturing mills. Typical savings: 10-25%.

Stock fabric programs: Standard colors from mill inventory avoid MOQ requirements and reduce lead time costs. Reserve custom dyeing for brand-differentiated colors.

Counter-seasonal buying: Textile manufacturing shows seasonal demand cycles. Purchasing during low season (typically July-August and post-Chinese New Year) yields better pricing and priority scheduling.

Annual agreements: Lock pricing for 6-12 months based on volume commitments. Protects against raw material price volatility.

Payment term optimization: Extended payment terms (net 30-60 days) improve cash flow. Offset against early payment discounts to determine net benefit.

Frequently Asked Questions

What minimum quantity must new brands order?

Stock fabric programs typically have no minimum—purchase what you need. Custom dyeing minimums vary: industry standard runs 500-1000 meters per color, though some mills accommodate 100kg (approximately 350-400 meters). New brands should start with stock colors to minimize financial risk while testing market reception.

Should yoga pants use 230 GSM or 260 GSM fabric?

230 GSM suits spring/summer products—lighter and more breathable but potentially less opaque under stretch. 260 GSM provides four-season versatility with better coverage and compression. For initial product development, 240-260 GSM minimizes risk while serving broad market needs. Reserve lighter weights for warm-climate markets and heavier weights for winter products.

Is nylon better than polyester for yoga wear?

Neither superior in absolute terms—depends on brand positioning. Nylon offers softer hand, better drape, and superior moisture absorption, justifying premium pricing. Polyester provides better color retention, easier care, and lower cost, appropriate for value-oriented products. Premium brands typically specify nylon; mass-market brands favor polyester. High-volume brands sometimes use both, differentiating product lines by fiber content.

How do I prevent color shade variations in bulk production?

First, request "lab dip" samples from actual production dyeing equipment, not bench-top samples. Second, specify color tolerance in contract (AATCC Grade 4 or specific ΔE value). Third, order complete color quantities in single dye lot when possible—splitting orders across multiple lots invites shade variation. Fourth, request shade cards showing acceptable tolerance range before approving bulk production.

Stock fabric or custom dyeing—which makes sense?

Stock programs offer speed (1-3 day delivery), no MOQ, and lower cost. Limited color selection and potential stock-outs represent drawbacks. Custom dyeing enables proprietary colors and consistent availability but requires higher MOQ, longer lead time, and premium pricing. Recommended approach: black, white, and neutral basics from stock; seasonal colors and brand signature colors custom-dyed.

What shrinkage rate should I expect?

Industry standard: ≤3% in any direction. Quality mills achieve ≤2%. During pattern development and cutting, add 2-3% length to compensate for shrinkage. Test actual shrinkage on sample fabric through complete laundry cycle before production commitment. Some mills offer "compacted" finishing that minimizes residual shrinkage.

Does higher spandex content always improve performance?

No. While increasing spandex raises compression and elasticity, exceeding 18% creates diminishing returns. Very high spandex content (20-25%+) reduces breathability, increases cost, complicates sewing, and may create unflattering fit on some body types. The 12-18% range represents optimal balance for general yoga applications.

Can production be expedited?

Yes, with caveats. Stock fabric ships within days. Custom orders can sometimes accelerate to 15-20 days with 10-20% rush premium, assuming raw material availability and open production capacity. Best results come from building supplier relationships and planning ahead. Last-minute rush orders may prove impossible during peak season (September-November).

How do I verify a factory's reliability?

Examine certifications—OEKO-TEX minimum requirement for credibility. Review customer references and request factory audit reports if available. Visit production facility if feasible—observe equipment condition, cleanliness, and organization. Request sample testing through independent laboratory rather than relying solely on factory results. Start with small trial order to evaluate quality and communication before major commitment.

What payment terms should I negotiate?

Standard practice: 30% deposit upon order confirmation, 70% balance before shipment. More conservative approach for new relationships: 30% deposit, 50% at production completion, 20% after inspection approval. This structure maintains leverage for quality issues. Established relationships may negotiate monthly billing cycles or extended terms.

Industry Developments for 2025

Sustainability Mandates: Recycled content fabrics increasingly standard rather than premium option. GRS-certified recycled nylon and polyester now approaching virgin fiber pricing. Major retailers setting minimum recycled content requirements (typically 20-50%) for activewear categories.

Functional Innovation: Antimicrobial treatments (silver ion, copper ion) becoming expected features rather than upgrades. Cooling technologies incorporating jade or other mineral particles gaining traction for hot yoga applications. Moisture management improving through multi-layer constructions that wick and dry 30% faster than conventional knits.

Supply Chain Evolution: Small-batch capability expanding as mills invest in flexible manufacturing. Digital sampling and 3D fabric visualization reducing physical sample rounds. More mills maintaining stock fabric programs to capture quick-turn business.

Regional Considerations: Guangdong Province (Dongguan, Guangzhou) offers comprehensive infrastructure and fastest lead times. Jiangsu Province (Changshu, Wuxi) provides largest production capacity for bulk orders. Zhejiang Province (Shaoxing) presents widest variety and competitive pricing. Fujian Province (Jinjiang, Shishi) specializes in athletic performance fabrics.

Implementation Roadmap

New Brand Launch Strategy

Start with market positioning clarity. Premium brands require nylon-spandex construction, 260 GSM weight, and complete certification package. Value brands can succeed with polyester-spandex, 240 GSM weight, and basic certifications.

Begin product development using stock fabric in black, white, and one neutral tone. This minimizes capital requirements while testing market acceptance. Three-color programs support initial launch.

Establish relationships with 2-3 mills rather than depending on single source. Compare pricing, service, and quality. Build redundancy into supply chain.

Test market response with 200-300 unit production run. Gather customer feedback on fit, comfort, and durability. Refine specifications before scaling volume.

Existing Brand Optimization

Audit current fabric specifications against performance standards in this guide. Identify improvement opportunities in elastic recovery, breathability, or color fastness.

Evaluate total landed cost including hidden factors. Compare current suppliers against direct mill sourcing to quantify potential savings.

Test alternative constructions through small prototype runs. Even minor specification changes (240 GSM to 250 GSM, 15% spandex to 18% spandex) can meaningfully impact performance or cost.

Implement annual agreement with primary supplier to lock favorable pricing and secure capacity allocation.

The yoga apparel fabric market rewards informed decision-making. Brands that master technical specifications, quality standards, and supplier evaluation will achieve superior product performance at competitive cost structures. Success requires moving beyond superficial fabric descriptions to understand the underlying factors that determine real-world performance, durability, and customer satisfaction.